How Gold Protects Against Inflation

Inflation does not just raise prices. It erodes your savings, weakens your purchasing power, and shifts wealth from the careful to the reckless. Over time, it makes people poorer without ever sending them a bill. But while paper currencies lose value, gold has remained a reliable store of wealth for over 5,000 years.

So how exactly does gold protect against inflation?

1. Gold Is a Real Asset, Not a Promise

Paper currencies, also known as fiat currencies, are backed by nothing more than government assurances. When inflation rises, those assurances carry less weight. Central banks can create more money, but they cannot create more gold.

Gold is tangible, limited, and does not depend on anyone’s word. It cannot be reduced in value by a political decision. When confidence in money declines, confidence in gold increases.

2. Gold Preserves Purchasing Power Over Time

Here is something few people consider.

In 1971, £100 could buy nearly three ounces of gold.

Today, that same £100 will not even buy one gram.

That is not because gold has risen sharply. It is because the pound has lost value. Gold does not inflate in worth. It maintains value. An ounce of gold today still buys roughly what it did fifty years ago in terms of goods, services, and land. The same cannot be said for any major currency.

3. Gold Moves Opposite to Currency Confidence

When inflation surges, central banks lose credibility. People begin to question the value of money itself. When that happens, gold typically rises. In times of high inflation, such as the 1970s or the years following 2008, gold has outperformed shares, bonds, and cash.

It is not just a form of protection. It acts as a direct response to falling confidence in paper money.

4. Gold Exists Outside the Financial System

Most traditional investments such as savings, bonds, or shares depend on the banking system and central bank policies. Gold does not. Physical gold, especially, has no counterparty risk. It is not based on someone else’s debt or obligation.

And in a world where bank failures, withdrawal restrictions, or negative interest rates are no longer far-fetched, holding gold outside the system is a powerful form of financial protection.

5. Central Banks Are Buying Gold Themselves

This is worth noting. While central banks insist inflation is under control and claim gold is outdated, they are quietly buying record amounts. In both 2022 and 2023, central banks made their highest gold purchases in more than fifty years.

Why are they doing this? Because they understand that when trust in paper money fades, gold holds firm.

If the very organisations contributing to inflation are protecting themselves with gold, it is worth asking whether you should too.

6. Gold Performs During Inflationary Crises

Here are a few examples.

In the 1970s, during stagflation, gold rose by more than one thousand three hundred percent while savings were eroded by inflation.

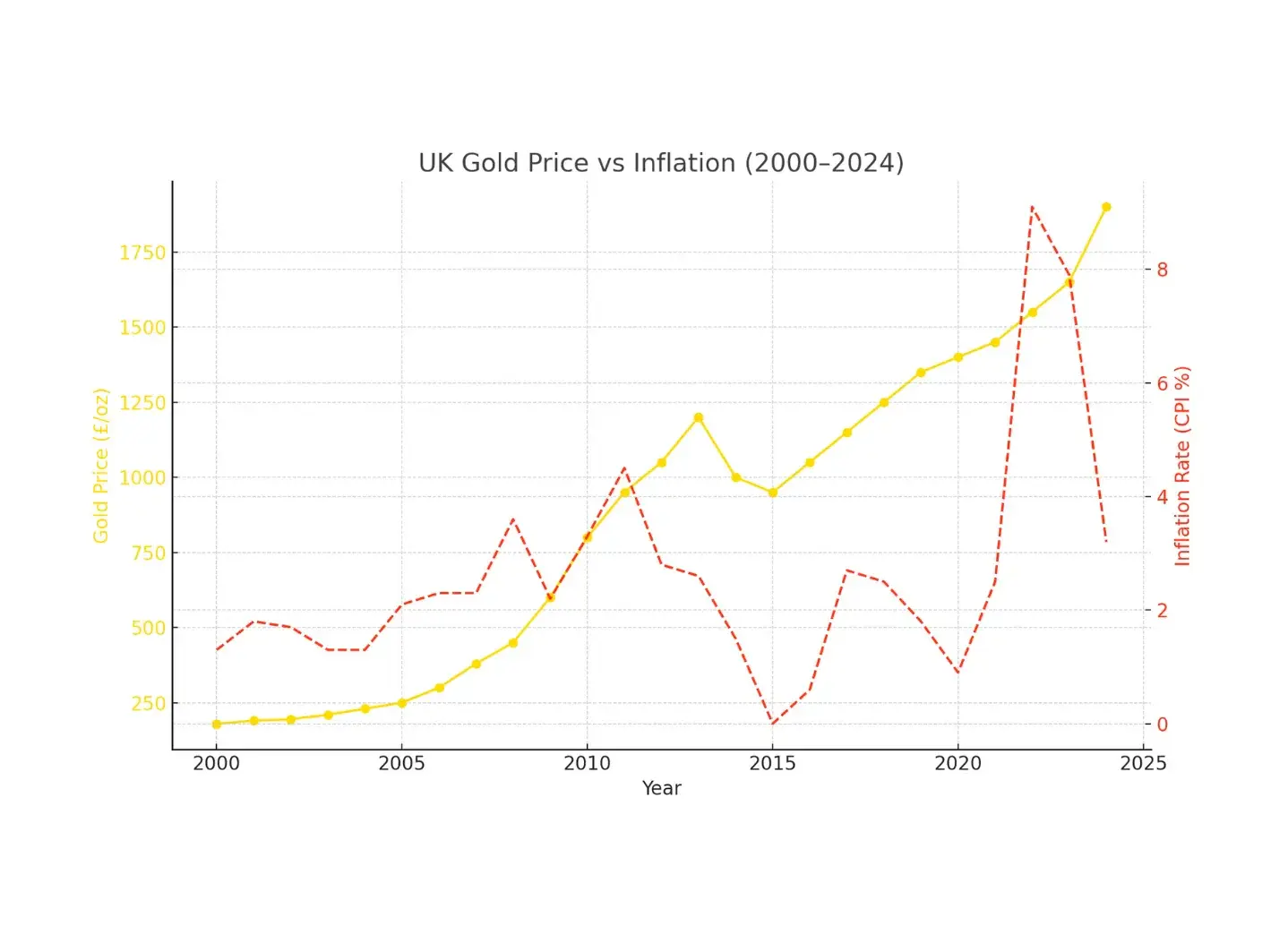

Between 2001 and 2011, during the aftermath of the dotcom crash and the global financial crisis, gold increased by over six hundred percent.

From 2020 to 2023, during the post-pandemic inflation surge, gold reached record highs across many currencies.

Gold does not just protect value. It often rises when other assets fail.

In Summary: Gold Is the Antidote to Inflation

Inflation is not only about rising prices. It is about falling trust. When money itself becomes uncertain, only real, lasting assets offer true security. Gold has proven its strength through every major crisis — not as a gamble, but as a form of defence.

Gold does not pay interest. It does not rely on market growth. It does not make promises. It simply lasts.

That is why experienced investors choose gold. Not only to grow wealth, but to protect it.