Inflation: The Silent Thief of Your Wealth

If you are like most people, you have probably noticed your weekly shop creeping up in price, your rent or mortgage stretching further, and your savings earning next to nothing. This is not your imagination. It is inflation. But what exactly is inflation, and why does it seem to quietly erode your financial stability year after year?

Let us take a closer look at what inflation really is, how it is measured, why it matters, and why many now see it not just as an economic phenomenon, but as a stealth tax on ordinary savers.

What Is Inflation?

At its core, inflation is the rate at which the general level of prices for goods and services rises, causing the purchasing power of money to fall. Put simply, £100 today buys you less than it did ten years ago, and far less than it did thirty years ago.

Inflation eats away at the value of cash savings. It makes the pound in your pocket worth less over time. While a little inflation is considered normal in modern economies, it is important to understand that inflation is not a natural law. It is the result of policy decisions.

How Is Inflation Measured?

In the UK, inflation is measured in several ways, and the method used can dramatically change how high or low it appears.

CPI (Consumer Price Index)

This is the headline rate most often quoted in the media. CPI measures the average change in prices of a basket of goods and services over time, including food, clothing, transport, and entertainment. However, it excludes housing costs, which is a major oversight considering accommodation is usually people’s single biggest expense.

RPI (Retail Prices Index)

An older measure that includes housing costs, such as mortgage interest payments and council tax. RPI generally shows higher levels of inflation than CPI and is still used in calculations like rail fare increases and some pensions. It tends to be used when it benefits the government, not the public.

CPIH (Consumer Price Index including Housing)

This is the Office for National Statistics’ preferred measure. It includes some housing costs such as rent and the cost of living in one’s own home (estimated using what is called imputed rent), but it still does not include key things like actual house prices or mortgage repayments.

The reality is that inflation statistics are selectively constructed. The version of inflation quoted depends on the message the government wants to promote.

What’s the Official Target and What’s Really Happening?

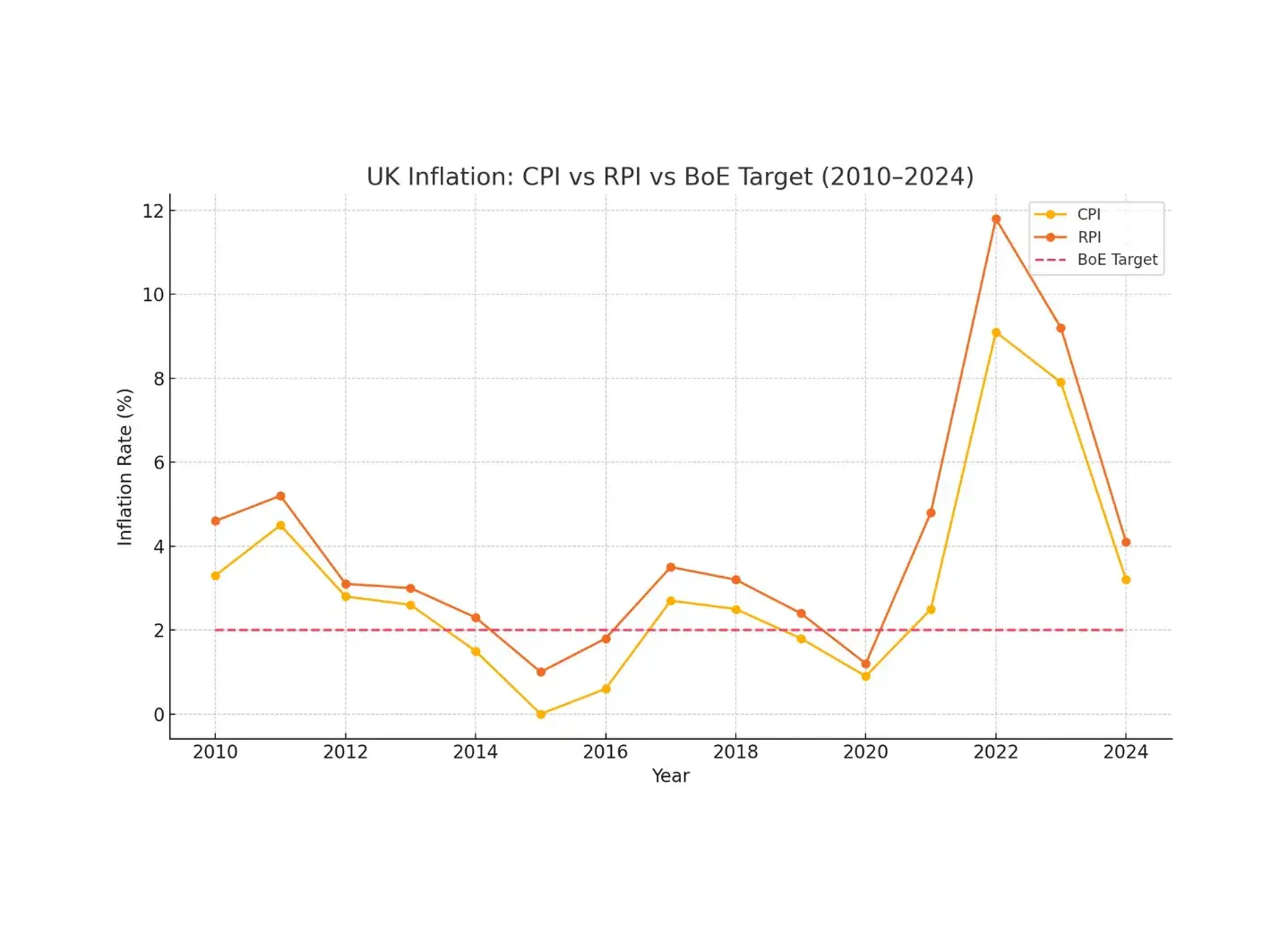

The Bank of England aims for an inflation rate of 2 percent to keep prices stable. Yet in recent years, inflation has soared far beyond this. Years of money printing, supply chain issues, wars, and a lack of investment in energy and infrastructure have let inflation loose.

Since 2022, UK inflation has often hovered around 9 to 11 percent. That is more than five times the official target. And that is based on CPI. If inflation were measured using RPI or based on the real rise in prices of essentials like food and housing, it would feel much higher to most people.

The Real Impact: How Inflation Destroys Wealth

Inflation is not just an abstract figure on a government report. It has a direct and damaging effect on your standard of living:

-

Savings lose real value. £10,000 in the bank with inflation at 10 percent loses £1,000 of purchasing power in just one year.

-

Wages rarely keep pace. Even if your salary increases, it often lags behind inflation. You feel richer on paper, but poorer in reality.

-

Fixed incomes suffer. Retirees relying on pensions or annuities watch their income lose value every year.

-

Savers are punished, borrowers are rewarded. Debt becomes cheaper to repay. Prudence is penalised, while excess is encouraged.

Inflation is often called a hidden tax, and that is exactly what it is. Instead of raising taxes, which is obvious and unpopular, governments allow inflation to quietly reduce the value of your money.

How Do Central Banks Try to Manage Inflation?

Central banks such as the Bank of England use a few basic tools to try to manage inflation.

Interest Rates

Raising rates is supposed to slow borrowing and spending, helping to bring inflation down. But higher rates also mean higher mortgage costs, increased business expenses, and a risk of recession.

Quantitative Tightening

This means selling off government bonds to take money out of the economy. However, it can make markets unstable and reduce government and public spending.

Forward Guidance

Also known as jawboning, this involves central banks trying to manage expectations by telling the public that inflation is under control, even when it is clearly not.

These tools are reactive, not preventative. In many cases, central banks are trying to clean up the mess they helped create by keeping rates too low and printing too much money for too long.

Why Inflation Will Not Disappear

Even if inflation slows, the damage is already done. Prices rarely come down — they just stop rising as quickly. That means you are now permanently worse off than you were two or three years ago.

With global tensions, energy instability, and sky-high government debt, leaders may find it easier to let inflation do the work of reducing their obligations. The cost of that approach falls on you.

What Can You Do About It?

In a world where money constantly loses value, many people are turning to physical gold as a way to protect their wealth.

Gold does not depend on government promises. It cannot be printed. It carries no counterparty risk. And unlike paper currencies, it has held its value for thousands of years, through empires, financial crises, and entire currency collapses.

Conclusion: Inflation Is a Choice, Not a Coincidence

Do not be fooled by polite language. Inflation is not just about prices rising. It is a silent shift of wealth — from savers to borrowers, from citizens to governments. It rewards recklessness and punishes responsibility. And it is not going away soon.

In today’s environment, protecting your capital is not a luxury. It is a necessity.